Woodies Multi Time Frame Forex Trading Strategy

Many people think of trading as a game of chance. Some even compare it to gambling. This could not be farther from the truth.

Yes, to some extent, trading is by chance. Nothing is sure in trading. No one knows what price would do in the next couple of hours or even in just the next few minutes. Price could move up and price could move down. Price could contract or it could become very volatile. Price would do whatever it wants to do. That is just the nature of the market.

However, trading is not all about chance. It is about probabilities. There are certain repeating patterns, characteristics and conditions which many traders have identified that could indicate where price might move next. These indications are not perfect but many of it could predict market movements with a relatively high degree of accuracy. Trading is about probabilities and the game is about increasing the odds in our favor.

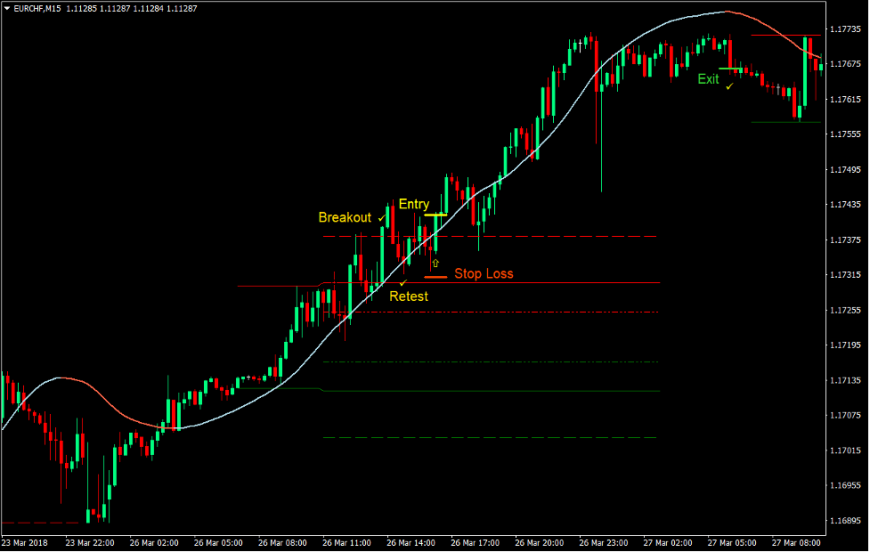

One of the best ways to stack odds in our favor is by using Multi Time Frame Analysis. This is the process of looking at different time frames in order to see what the market is doing coming from different perspectives. Traders who are trading on the 1-hour chart could zoom out to the 4-hour and daily chart to see what the long-term trend is. They could also zoom in on the 15-minute or 5-minute chart to see if the short-term trend is in their favor. This aligns the analysis on the time frame being traded, the long-term trend and an accurate entry based on the lower time frame.

This process might be cumbersome for new traders. However, there are indicators that could help traders go around this. These indicators could display what the market is doing on different time frames even on a single chart.

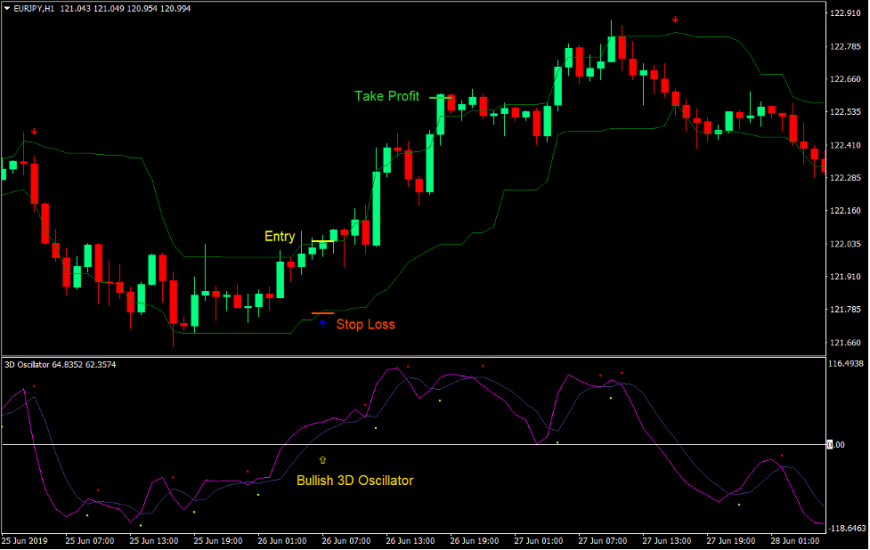

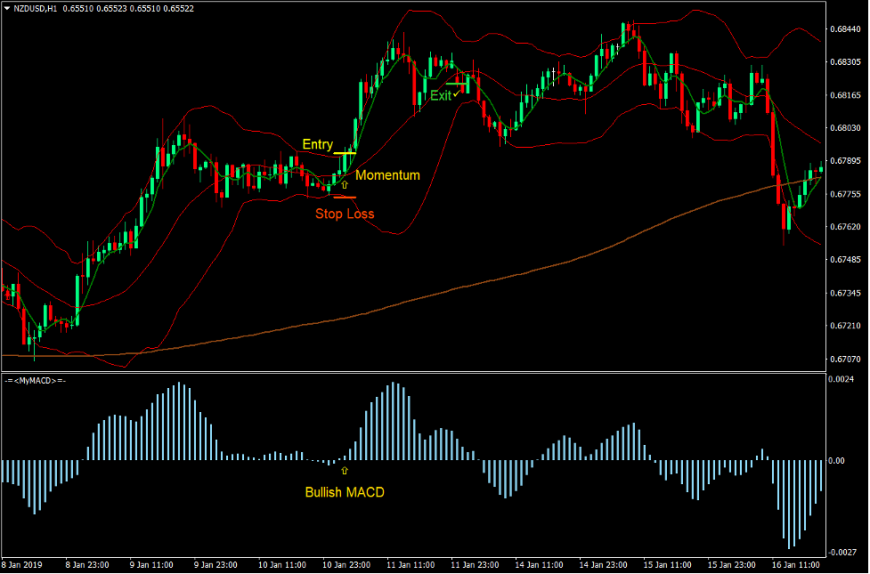

Woodies Multi Time Frame Forex Trading Strategy is based on an analysis coming from different time frames using a custom indicator. It analyzes momentum and trend on different time frames and provides trade setups when all the time frames are aligned.

All Woodies CCI v1.0

Table of Contents [show]

All Woodies CCI is a custom technical indicator based on the Commodity Channel Index (CCI) indicator.

The classic CCI is an oscillating indicator developed to identify momentum. It could also be used to identify trend direction and overbought or oversold market prices.

The CCI oscillates freely from positive to negative and vice versa. A positive CCI indicates a bullish bias while a negative CCI indicates a bearish bias.

The CCI also has markers on -200, -100, 100 and 200.

A CCI that has breached 100 could indicate a strengthening bullish momentum, while a CCI that has fallen below -100 could indicate a strengthening bearish momentum.

On the other hand, price is considered overbought if the CCI is above 200 and oversold if it is below 200.

The All Woodies CCI indicator provides information about the CCI applied on all time frames. This information is then displayed on a single chart. This is very useful for traders who would want to know how the market is behaving on different time frames.

Trading Strategy

This trading strategy is a momentum trading strategy that uses the All Woodies CCI v1.0 indicator to identify trade entries.

It provides trade signals whenever the trend and momentum on the 5-minute, 15-minute and 1-hour charts are aligned.

The 1-hour chart would serve as our long-term timeframe. Trades are filtered based on whether the bars are positive or negative.

The 15-minute chart would serve as our main time frame. On this chart, trade signals are taken whenever the bars breach 100 on a bullish momentum or fall below -100 on a bearish momentum.

The 5-minute chart would be our short-term momentum filter. Trades are taken only when the bars on this chart agree with the trend on the 1-hour chart and the momentum signal on the 15-minute chart.

Indicators:

- All woodies cci v1.0 (default setting)

Preferred Time Frame: 15-minute chart

Currency Pairs: major and minor pairs

Trading Sessions: Tokyo, London and New York sessions

You must log in to submit a review.